Stay in control of your debit orders

There’s a very good reason why you receive DebiCheck notifications. By approving new debit orders you will make your Capitec account even more secure.

There’s a very good reason why you receive DebiCheck notifications. By approving new debit orders you will make your Capitec account even more secure.

You don’t have to approve a DebiCheck debit order every single time it goes off your account. This quick approval process happens when you sign up for a new contract and will help you to control who can debit your account and help reduce the problem of unwanted debits. Only if a DebiCheck mandate changes, will it need to be reapproved.

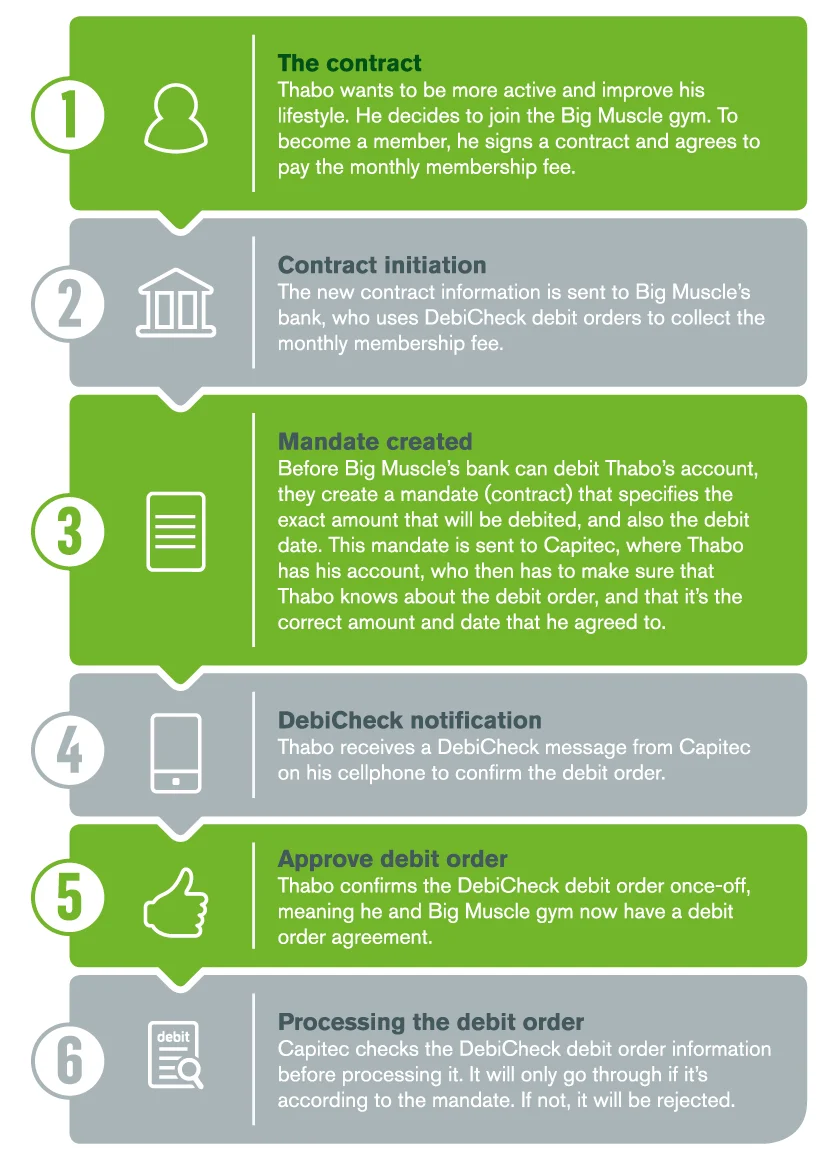

Here’s how it works:

If the DebiCheck debit order will be debited from your Capitec account, you can approve it:

Using our app is quick and easy. Also, if you’re a Vodacom, MTN, Cell C or Telkom subscriber you automatically qualify for zero-rated data.

If you don’t have our app, you can use USSD (*120*3279#) to instantly approve DebiCheck orders without any hassle.

You can activate cellphone banking at any branch. If you can’t access cellphone banking, you can approve DebiCheck debit orders by visiting a branch or by calling our Client Care Centre on 0860 10 20 43.