Work out loan affordability

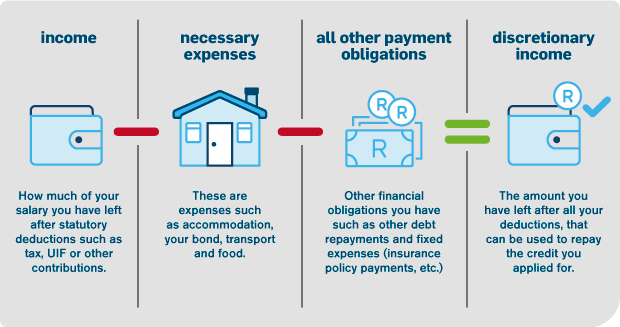

Affordability is about how much money you have left after expenses & financial obligations have been paid, which could be used to repay the loan you apply for.

Affordability is about how much money you have left after expenses & financial obligations have been paid, which could be used to repay the loan you apply for.

Credit providers use the information on your salary slip and bank statements to see whether you'll be able to repay. Here's how you can work out your own affordability.