Our 2024 Results

Watch the presentation of our audited financial results for year ended 29 February 2024.

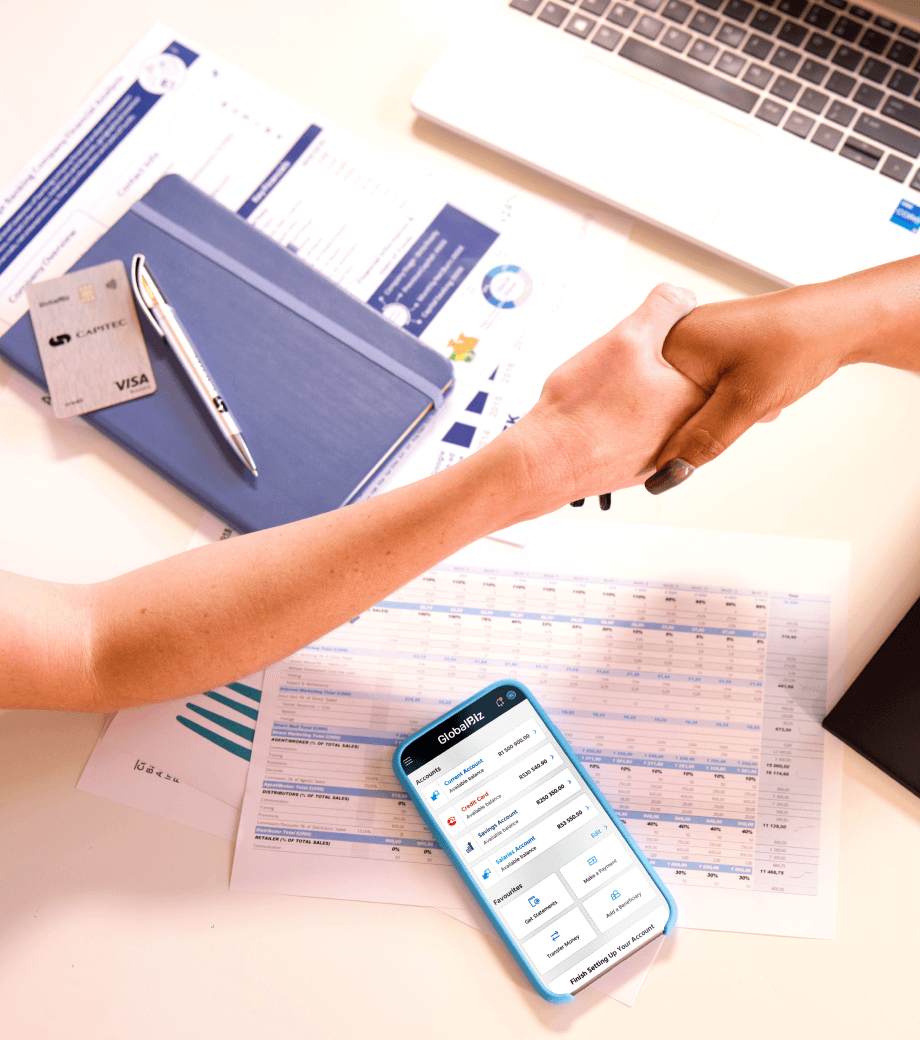

It doesn’t matter if your business is big or small, if you're starting out or branching out. We have payments, credit, savings and insurance solutions to support and grow any start-up, SME or established enterprise.

We make business banking simple with one account for life. Our day-to-day transactional account is available to all businesses at the same price, with a simple and transparent fee structure.

Here's what you get, for what you pay:

See how simple and easy digital banking can be. Customise your banking for instant access to the things that matter the most to you, so you can effortlessly run your business from our app and online banking platform.

A Relationship Banker will give you personalised service and support for all your business needs.

Start using your account today! Call our Relationship Suite on 0860 30 92 50 if you need help and let's get down to business.

Choose a bank that not only makes running your business simpler, but treats you like somebody who also has a personal life. At Capitec Business, we’re committed to innovation and use technology to enhance our banking services so you can focus on the things that really matter to you.

Read more

We know that it takes passion, dedication and commitment to build a business. So let us help you with simple savings and investment products with competitive interest rates that offer you value to grow your profits.

Read more

We want you to spend your time and money on running and growing your business, not on worrying about it. That’s why we protect your business against all possible risks with affordable short and long-term insurance.

Read more

We have simplified the credit application process to make it easy for you to access the credit you need to grow your business or support your cash flow. We offer many different credit options, so read more to see which of them are right for your business and what you’re aiming to achieve.

Read more