Personal

Sign in to your Personal Banking profile or easily switch to your Business Banking profile above.

Personal Online Banking

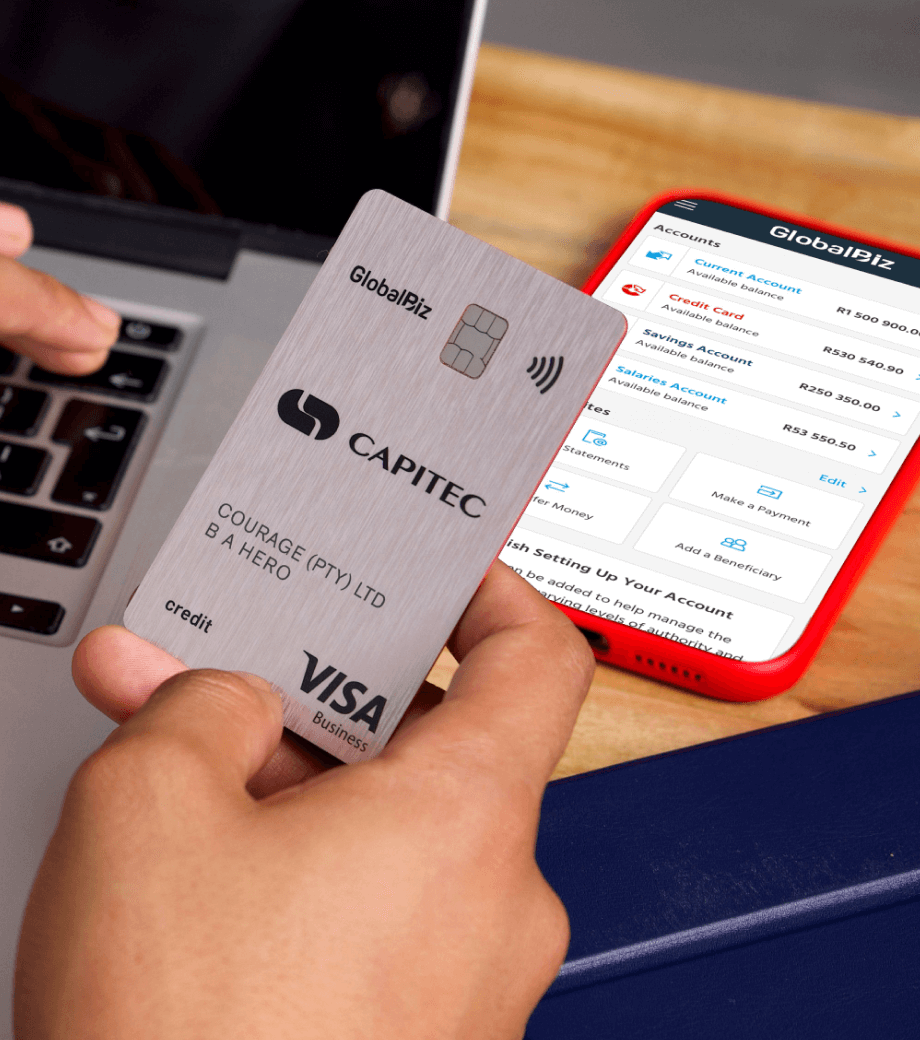

Business

Sign in to your business banking profile below, or click above to easily switch to your personal banking profile. Alternatively, sign in to your old profile here.

Business Online Banking