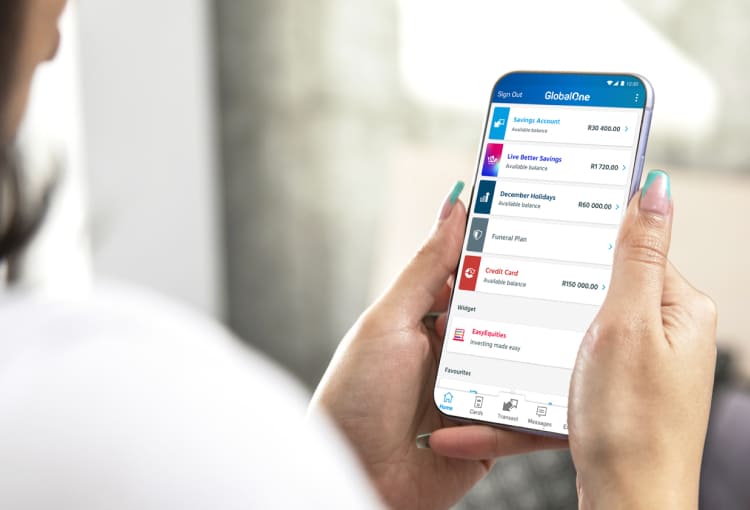

Bank on our app

Pay people and accounts, make immediate payments, get credit and more without having to visit a branch.

Pay people and accounts, make immediate payments, get credit and more without having to visit a branch.

Simply search “Capitec Bank” in your app store or use the links below to download our remote banking app.

The app is designed with your convenience in mind, with quick and simple navigation, as well as the following added features:

Simply take a selfie and enter your ID number – no branch visit needed!

See all your accounts and balances at a glance.

Scan all the major QR codes straight from the app.

For a quick, safe way for Capitec clients to instantly pay money into your account.

Set up shortcuts on your home and sign-in screens for one-tap access to the features you use the most.

Get a quick overview of how you're spending your money with categories like food, transport or communication.

You can receive all your Money In/Money Out messages either on our app for free, or as an SMS at a cost.

Sign in and authenticate with fingerprint or facial recognition if your phone supports this.

It’s free, safe and easy to load for all your app, online and scan to pay transactions.

Turn your card’s tap to pay function on and off.

Our app is free to download and there’s no monthly subscription.

It's also free to use on most networks: MTN, Vodacom, Cell C and Telkom subscribers pay zero data charges when they use our app.

Beneficiary payments can be done at a fraction of the branch cost.

Take control of your money and track your spending.

You can access the app on the go from your cellphone.

Every transaction is protected by your Remote PIN, so never share it – keep it secret.

View your profile using the menu at the top of the home screen and do the following: